| CURL CURL | ||||||

| 8/64 Carrington Parade | ||||||

| Off Market – Contact Agent | ||||||

|

| CURL CURL | ||||||

| 5/62 Carrington Parade | ||||||

| For Sale – Open Wed 12pm Guide $1,900,000 | ||||||

|

| CURL CURL | ||||||

| 3/64 Carrington Parade | ||||||

| For Sale Off Market | ||||||

|

| FRESHWATER | ||||||

| 5/110 Lawrence Street | ||||||

| Auction | ||||||

|

| FRESHWATER | ||||||

| 41 Wyadra Avenue | ||||||

| SOLD – Off Market | ||||||

|

| QUEENSCLIFF | ||||||

| 7/132 Queenscliff Road | ||||||

| SOLD | ||||||

|

| QUEENSCLIFF | ||||||

| 2/117-119 Crown Road | ||||||

| $1,300,000 | ||||||

|

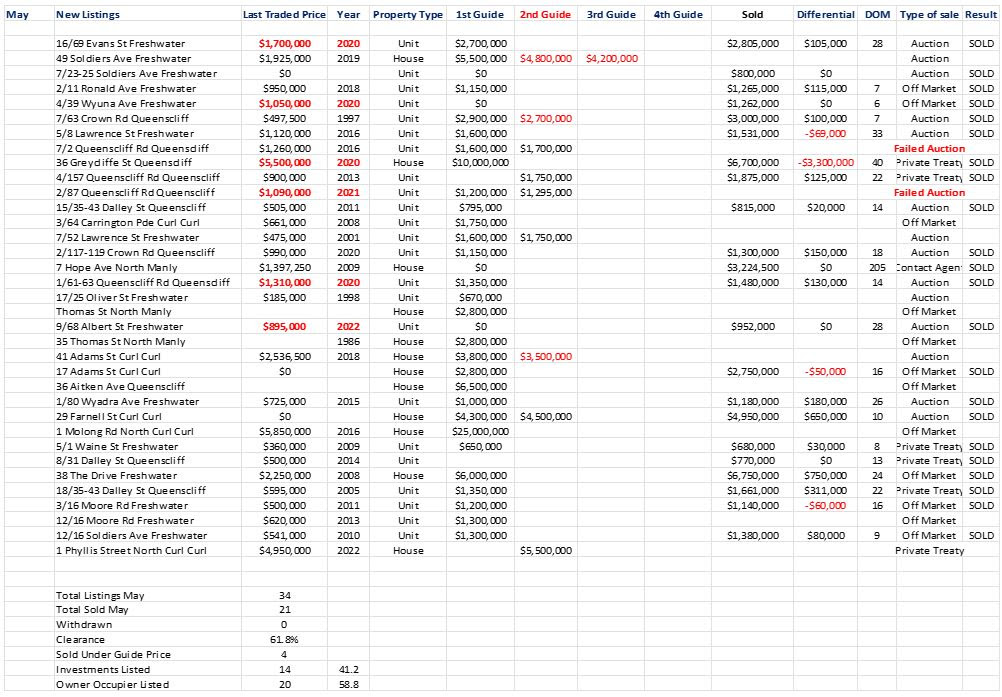

Statistics of note:

The volume of listings during the same time period last year:

* Freshwater in May 2022 8 vs May 2023 = 13 / June 2022 = 25 vs June 2023 = 4

* Curl Curl 2022 in May 2022 = 2 vs May 2023 = 4 / June 2022 = 4 vs June 2023 = 2

* North Manly in May 2022 = 3 vs May 2023 = 2 / June 2022 = 2 vs June 2023 = 1

* North Curl Curl in May 2022 = 2 vs May 2023 = 2 / June 2022 = 6 vs June 2023 = 3

* Queenscliff in May 2022 = 5 vs May 2023 = 8 / June 2022 = 7 vs June 2023 = 9

Yr on Yr May listings – 31%, Yr on Yr June listings -48.6%

The volume of sales during the same time period last year:

* Freshwater in May 2022 = 12 vs May 2023 = 17 / June 2022 = 11 vs June 2023 = 14

* Curl Curl in May 2022 = 3 vs May 2023 = 3 / June 2022 = 2 vs June 2023 = 1

* North Manly in May 2022 = 2 vs May 2023 = 6 / June 2022 = 2 vs June 2023 = 2

* North Curl Curl in May 2022 = 1 vs May 2023 = 8 / June 2022 = 6 vs June 2023 = 3

* Queenscliff in May 2022 = 6 vs May 2023 = 6 / June 2022 = 4 vs June 2023 = 10

Yr on Yr May + 57.7% increase, Yr on Yr June +16.6% increase

Summary, it seems whilst the market was edging an average of 20% down across the suburbs and nation in 2022, listings were greater in 2022, and sales were lower and more difficult, as opposed to volume dramatically down in 2023, but overall sales up due to lack of stock and buyer demand.

So….what’s really going on and where is it going?

Before Easter, we had seen intense buying and inspection activity with open house volumes increased dramatically, and the FOMO (Fear of Missing Out) etch up a few notches and some incredible prices being achieved as if 2022 demise or downfall, did not even occur.

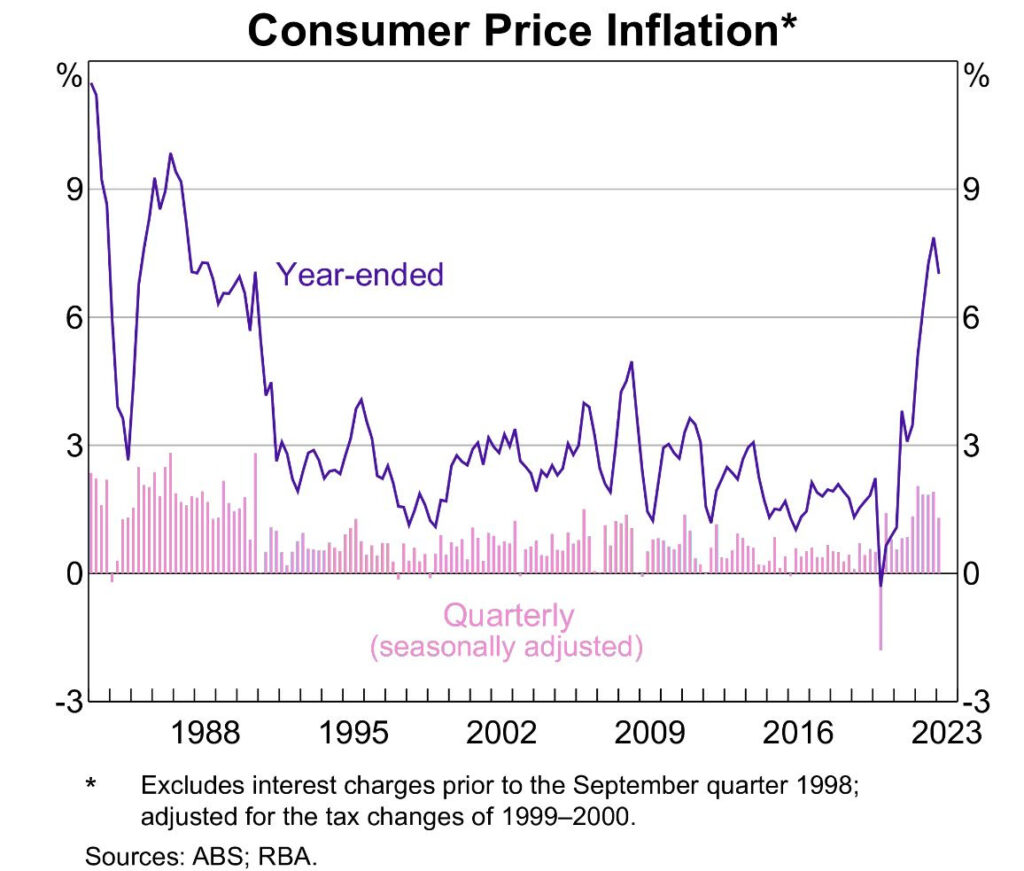

The RBA initial one month pause, did provide a misplaced and possibly misrepresentation of rates actually slowing down. The following month increase did realign the longer term intentions with infaltion (CPI) being 6.8% and cash rates up again.

Article:

Summary:

While property prices were rebounding, it was unclear how long this could last, Oliver said. This, combined with the continuing rise in interest rates, and a growing risk of recession, which would lead to job losses, meant the proportion of homes resold at a loss could climb.

The rain on the parade, even with the lowest stocklevels since 2015, has assisted in keeping prices at nearly all time highs, the sting seems to have altered and although buyers are looking, they are less inclined to trigger immediate offers, and are most definitely considering and pulling back their previous aggresive tendancies.

The Bank of England (BOE) last week certified their CPI worries with inflation increasing dramatically to 8.7% and BOE raising rates by 0.50 basis points to reach a 5.0% cash rate. This has taken the public and financial institutions by surprise, and the ominous wanrning signs are there for recession warnings.

The future variables at stake:

* Expiring Fixed Interest Only Loans: This is now just the beginning of a long line of fixed loans soon to expire frokm now until December, 2024. There will be pressure on approximately 20% of the mortgage holders to maintain servicibility.

* Summer stock will always naturally come, and historically the “call in appraisal rate” commences in July and August

* Inflation: How long does it take to go from near 7% to the happy government band of 2-3%? Judging by history, inflation took from 1988 to 1993 to fall back in line according to the ABS. However, being in a more complex society, with many more measures in place to provide the necessary warnings, we can see that CPI is more than likely to subside by 2025-2026. At that point, a period of stability and business growth needs to be coupled with employment.

It is predicted that a slower 12 months is ahead, and with a spending contraction going on, the market is likely to have a decline to the tune of between 6-8% over the next 12 month time period.

The ABS released their CPI data for May being 5.6%, the smallest annual jump in 12 months, but a year on year rise of 6.8% in April.

The RBA now may be more standoffish in making a decision or pausing again. The issues being the United Kingdown, New Zealand and USA all being higher cash rates, and wanting to stem any upward swing in fueling inflation. With this in mid, my guesstimate would be maintaining a discreet distance and to keep the pressure on weighing down inflation.

THE PRESSURE:

The majority of media releases at present are focussing on RE-SALES. This is when a property was resold in a short time frame of ownership. They are seemingly regarding repeated sales since 2020.

In our immediate area, several resellers have cropped up such as:

From the desk

Number2023-16Date4 July 2023

At its meeting today, the Board decided to leave the cash rate target unchanged at 4.10 per cent and the interest rate paid on Exchange Settlement balances unchanged at 4.00 per cent.

Interest rates have been increased by 4 percentage points since May last year. The higher interest rates are working to establish a more sustainable balance between supply and demand in the economy and will continue to do so. In light of this and the uncertainty surrounding the economic outlook, the Board decided to hold interest rates steady this month. This will provide some time to assess the impact of the increase in interest rates to date and the economic outlook.

Inflation in Australia has passed its peak and the monthly CPI indicator for May showed a further decline. But inflation is still too high and will remain so for some time yet. High inflation makes life difficult for everyone and damages the functioning of the economy. It erodes the value of savings, hurts household budgets, makes it harder for businesses to plan and invest, and worsens income inequality. And if high inflation were to become entrenched in people’s expectations, it would be very costly to reduce later, involving even higher interest rates and a larger rise in unemployment. For these reasons, the Board’s priority is to return inflation to target within a reasonable timeframe.

Growth in the Australian economy has slowed and conditions in the labour market have eased, although they remain very tight. Firms report that labour shortages have lessened, yet job vacancies and advertisements are still at very high levels. Labour force participation is at a record high and the unemployment rate remains close to a 50-year low. Wages growth has picked up in response to the tight labour market and high inflation. At the aggregate level, wages growth is still consistent with the inflation target, provided that productivity growth picks up.

The Board remains alert to the risk that expectations of ongoing high inflation will contribute to larger increases in both prices and wages, especially given the limited spare capacity in the economy and the still very low rate of unemployment. Accordingly, it will continue to pay close attention to both the evolution of labour costs and the price-setting behaviour of firms.

The Board is still expecting the economy to grow as inflation returns to the 2–3 per cent target range, but the path to achieving this balance is a narrow one. A significant source of uncertainty continues to be the outlook for household consumption. The combination of higher interest rates and cost-of-living pressures is leading to a substantial slowing in household spending. While housing prices are rising again and some households have substantial savings buffers, others are experiencing a painful squeeze on their finances. There are also uncertainties regarding the global economy, which is expected to grow at a below-average rate over the next couple of years.

Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will depend upon how the economy and inflation evolve. The decision to hold interest rates steady this month provides the Board with more time to assess the state of the economy and the economic outlook and associated risks. In making its decisions, the Board will continue to pay close attention to developments in the global economy, trends in household spending, and the forecasts for inflation and the labour market. The Board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that.

41 WYADRA AVE, FRESHWATER – SOLD off market

Verified by RateMyAgent

Overall, our experience with James Smyth and Smyth Estate Agents was exceptional. If you’re searching for a real estate agent who is honest, possesses integrity, and consistently goes above and beyond for their clients, James is the perfect choice. We couldn’t be happier with the outcome of our sale, and we are grateful for James’ dedication and professionalism throughout the entire process.

The speed at which James sold our property was truly remarkable, and it is a testament to his excellent negotiation skills and strategic marketing approach. He leveraged his extensive network and conducted a highly effective off-market campaign that attracted qualified buyers and resulted in a successful sale.

One aspect we truly appreciated was James’ willingness to provide advice and feedback regarding our sale. He took the time to understand our goals and priorities, offering valuable insights that helped us make informed decisions. We always felt supported and confident in James’ recommendations.

We have known James for several years and from the moment we engaged James as our agent, it was evident that he possesses a strong sense of honesty and integrity. Throughout the entire process, James consistently demonstrated professionalism and a deep understanding of the real estate market. His expertise and knowledge of the local area were invaluable in guiding us through the selling process.

We would highly recommend James Smyth from Smyth Estate Agents for anyone looking to sell their property. James recently sold our property in Freshwater within a remarkable six-day off-market campaign, exceeding our expectations in every way.Sold within 6 Days!!

2/117-119 CROWN ROAD, QUEENSCLIFF – SOLD block record

Verified by RateMyAgent

Thanks team SEAHaving known James for 15+ years, he made the choice easy with market knowledge, professionalism, great rates and value for money. After purchasing and selling a number of properties in the area,

James and the team made the process of selling an easy and enjoyable experience yet again, and to top it off, a NEW RECORD for this investment property.Make your sale easy.