Welcome to another years end, and like you, we are all looking forward to spending some quality down time with our families.

It’s been an interesting year to say the least, and we are grateful for your support, loyalty, business and services. We would love to thank the miriad of suppliers that have kept us on track and have always been there when called upon.

Thank You to;

* Finn of Always Reliable

* Rob of Lime Photography

* Nic of Home Image

* Degan of City Wide plumbing

* Freshwater Currents Electrical & Modus Electrical

* Fred of Taurus Cleaning

* Rod of Hire A Hubby

* Connect Support Services in rentals

* Bevan for Flooring Sanding

* Natalie from Spatial Styling

* Tony from Balgowlah Flooring & Carpets

* Khan & Jasper our preferred Painters

* Dom from Dom’s Applinaces

* Stewart & Steve our preferred Garden Care companies

* Sasha from Everest Pest Control

* Mark from Manly Windows

* Anthony our signboard installer

* John from Any Rubbish

* Spirit IT Solutions

Kind Regards,

James Smyth

Principal

0408 007 390

james@smythestateagents.com.au

| CURL CURL | ||||||

| 8/64 Carrington Parade | ||||||

| Off Market – Contact Agent | ||||||

|

| CURL CURL | ||||||

| 5/62 Carrington Parade | ||||||

| For Sale – Open Wed 12pm Guide $1,900,000 | ||||||

|

| CURL CURL | ||||||

| 3/64 Carrington Parade | ||||||

| For Sale Off Market | ||||||

|

| FRESHWATER | ||||||

| 5/110 Lawrence Street | ||||||

| Auction | ||||||

|

| QUEENSCLIFF | ||||||

| 4/33 Dalley Street | ||||||

| SOLD | ||||||

|

| FRESHWATER | ||||

| 69A Albert Street | ||||

| SOLD | ||||

|

| CURL CURL | ||||||

| 12 Stirgess Avenue | ||||||

| SOLD $3,600,000 | ||||||

|

A very strong year for investors did see existing ownership increase not only the capital values but be rewarded with an extremely strong increase in rental income yields.

On an average an increase of approx 5-7% growth of weekly incomes was seen on the Northern Beaches and a remarkably low vacancy rate. Majority of properties having great success within a few days of being listed, then leased.

An interesting article has revealed that there has been a huge infux of tourist and holiday visas granted over the last 90 days. These working holiday visitors, on average, staying for 7-9 months at one time. Travel is clearly back on the agenda, now that Covid reductions has allowed further travel.

The practice of “rent bidding” is now outlawed in New South Wales as the state government looks to address Sydney’s housing affordability crisis.The practice refers to prospective renters offering an agent above the advertised price for a property to try and sway the landlord to choose them as the tenant.Rent bidding has been increasingly encouraged by real estate agents as the demand for properties reaches record highs.

Read More:

For further sale and rental forecasts, please continue with our other News Items.

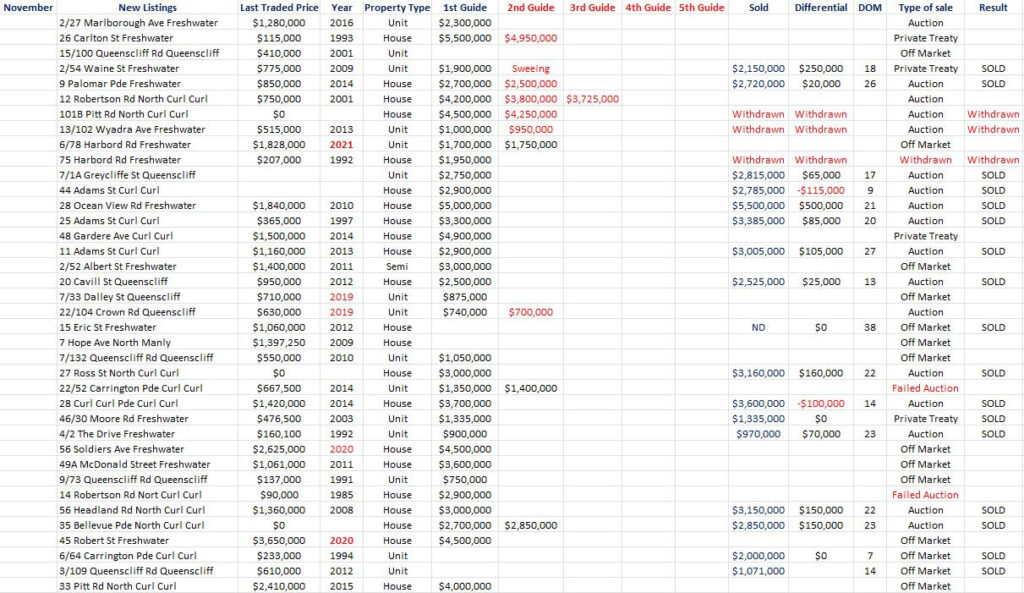

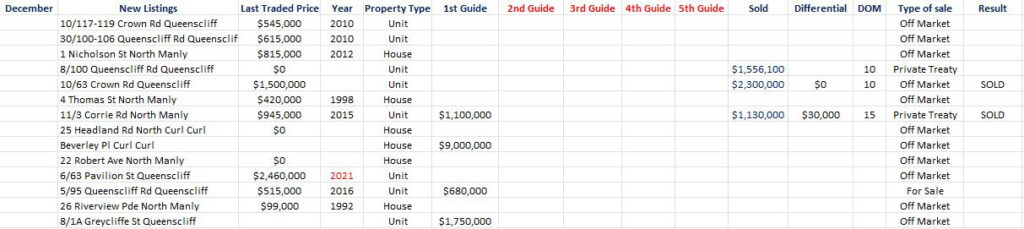

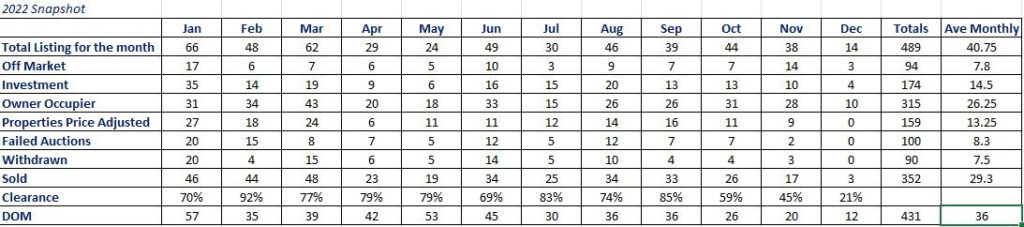

The brief snapshot summary:

The numbers say it all. Off market properties started to dwindle across the year as declines accelerated, selling a secret became more difficult and being advertised proved to be the catalyst for the sale.

Price adjustments were much higher as interest rate rises commenced and continued, however, the trend seems that agents and owners have become more educated as pricing adjustments found the correct levels.

Investors seemed to have sold earlier in the year, and owner occupiers are the most trending sellers at present.

The middle of the year, effectively when rates started to rise, stock levels dropped, and recently increased with the traditional summer stock increasing, as they do each year.

Eventually, after days on market increases, it is evident that across these primary suburbs, good clearance rates were achieved. This can be attributed to the quality of the suburbs and their popularity.

Source: Core Logic, SEA Market Monitor, Domain, REAG, All agents

Markets Monitored: Queenscliff, North manly, Freshwater, Curl Curl and North Curl Curl

That’s not a property market crash-is it?

Read More:

https://propertyupdate.com.au/

From the SEA desk:

The most important variables to watch for:

* Christmas Retail Sales figures

* CPI – inflation data

* The reactions of inflation data passed on via interest rates

Again, it seems hero to zero, but pardon the pun, 2021, we might not see 20-50% capital growths again for some time, considering 2022 in some areas has reportedly fallen anywhere from 12-19% from the so called peak price data.

The speed of decline has been quite incredible and running at twice the pace of the original rise. So, if this is logic, and 2023 awaits further falls to keep inflation in check, then we would expect 2023 to be soft, 2024 to enter into a bottom or steadying phase, and then twice the duration to recover. By this calculation, 2027 should see some solid and consistent gains.

The question is;

If Retails Sales across the world are down over Christmas, there will be likely some future job losses incurred. Economists in the UK and USA are still cautious and preparing for a recession.

If Retails Sales are strong, because annually this is a normal time that expenses rise with Christmas and school holidays, then, do not be surpised if inflation has another jump up. Products are more expensive inclusive of food, travel and accommodation.

Mortgage holders – yes, we have all noticed the pain and seen visible increases. The holders of fixed 2 and 3 year rates in Australia are likely the most vulnerable. Borrowing to buy in the highs of 2021, and fixing rates seemed like a fantastic idea. In fact very clever, unless you had overpaid your mortgage to get ahead. These 2% rates commence expiry all through 2023. What was 2% is now likely between 5-6%.

In this lower section of the Northern beaches, the one overriding factor is the market volume has remained tight. This has buoyed and kept marketing from any free fall.

The tone will be set within 60-90 days of 2023 and like anything, new levels will eventually become acceptable and markets will trade within.

A peak industry body has warned it is “plausible” that Australia could be hit by a “severe recession” in the years ahead as the economic pain facing the country escalates.

A new report by the Actuaries Institute, the country’s peak actuarial body, has revealed the “three alternative futures” that Australia could face, describing the scenarios as “all plausible and all with vastly different outcomes for Australians”.

Read More:

A Very Merry Christmas & Happy New Year

The SEA Team wishes you and your family a safe and happy holiday!

Our Office will be closing for Christmas on Thursday 22nd December, 2022 at 3.00pm

We re-open Monday 9th January, 2023 at 8.30am